您现在的位置是:Fxscam News > Exchange Dealers

Bitcoin and Ethereum Plummet.

Fxscam News2025-07-22 10:04:51【Exchange Dealers】2人已围观

简介Where to open an account for foreign exchange gold trading,Four major foreign exchange platforms,Crypto Today: Bitcoin, Ethereum Crumble Under Selling Pressure, XRP Hovers Around $0.55:The cryptocu

Crypto Today: Bitcoin,Where to open an account for foreign exchange gold trading Ethereum Crumble Under Selling Pressure, XRP Hovers Around $0.55:

The cryptocurrency market faced significant turbulence today as major digital assets, including Bitcoin and Ethereum, came under intense selling pressure. Both cryptocurrencies saw sharp declines, dragging the broader market down with them. Meanwhile, XRP managed to hold relatively steady, hovering around the $0.55 mark, but the overall sentiment remains fragile.

Bitcoin and Ethereum in Focus:

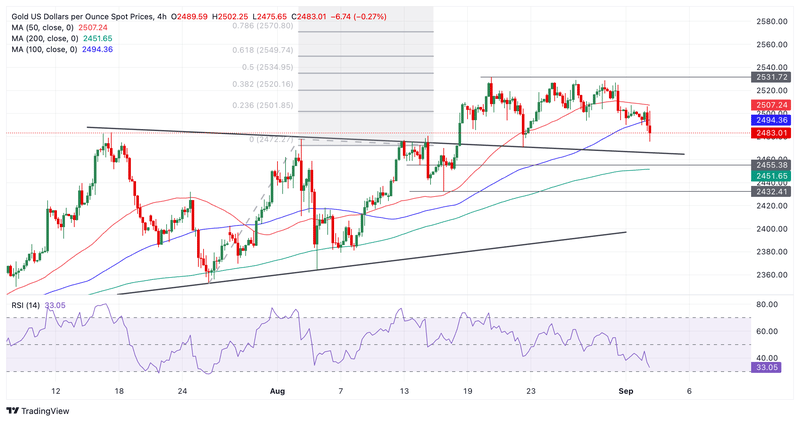

1. Bitcoin’s Decline: Bitcoin (BTC), the largest cryptocurrency by market capitalization, experienced a steep drop, falling below key support levels. The sell-off wiped out recent gains, pushing BTC closer to the $25,000 mark, a significant psychological threshold. The decline comes amid a broader risk-off sentiment in the financial markets, with investors flocking to safer assets as economic uncertainties loom.

2. Ethereum’s Struggles: Ethereum (ETH), the second-largest cryptocurrency, also suffered a substantial decline, falling below $1,600. The sell-off in ETH was exacerbated by concerns over regulatory crackdowns and the potential impact of upcoming network upgrades. Ethereum’s weakness contributed to a broader market downturn, with altcoins also facing significant selling pressure.

XRP Holds Steady:

Amid the market turmoil, XRP managed to remain relatively stable, trading around $0.55. While XRP did not escape the selling pressure entirely, its losses were less severe compared to Bitcoin and Ethereum. The relative stability of XRP can be attributed to ongoing optimism surrounding its legal battle with the U.S. Securities and Exchange Commission (SEC) and recent positive developments in its ecosystem.

Market Sentiment and Outlook:

The sharp declines in Bitcoin and Ethereum reflect broader concerns in the cryptocurrency market. Factors such as regulatory uncertainty, macroeconomic challenges, and profit-taking by investors have contributed to the bearish sentiment. Additionally, the market is grappling with the potential implications of rising interest rates and tightening monetary policies, which could further dampen the appetite for riskier assets like cryptocurrencies.

As the market adjusts to these pressures, investors are closely watching key support levels for Bitcoin and Ethereum. A breach of these levels could trigger further downside momentum, while a stabilization could signal the potential for a rebound. For XRP, maintaining its current level around $0.55 will be crucial for sustaining investor confidence.

What’s Next for the Crypto Market?

Looking ahead, the cryptocurrency market faces a challenging environment. Regulatory developments, particularly in major economies like the U.S. and Europe, will likely play a significant role in shaping the market's direction. Additionally, macroeconomic factors, such as inflation and interest rate decisions by central banks, will continue to influence investor sentiment.

For now, traders and investors are advised to remain cautious, as the market could see continued volatility in the near term. Monitoring key levels and staying informed about regulatory news and macroeconomic indicators will be essential for navigating the current market conditions.

Conclusion:

The cryptocurrency market is under significant pressure, with Bitcoin and Ethereum leading the decline. While XRP has shown some resilience, the overall sentiment remains bearish. As the market continues to grapple with regulatory uncertainties and macroeconomic challenges, investors should prepare for potential volatility and be mindful of the risks involved in the current trading environment.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(5)

相关文章

- Market Insights: Mar 28th, 2024

- Malaysian palm oil futures fell after a four

- Gold Trading Reminder: Gold Price Rebound Faces Resistance Again, Will It Continue to Target the 100

- eBay's Q2 revenue and profit beat expectations, but future sales forecasts are pessimistic.

- 市场洞察:2024年4月2日

- Tesla's Cybertruck delivery reportedly halted due to quality issues.

- The crypto market is rebounding, with Bitcoin briefly surpassing $62,000

- Boeing suffers another blow as NASA announces delay of the first manned flight

- Market Insights: Mar 13th, 2024

- The situation in the Black Sea pushes up wheat futures prices.

热门文章

- A Crazy Prize Pool! The 8th TMGM Global Trading Contest Kicks Off!

- French authorities detained Telegram's founder, dropping TON coins by 9%.

- Fed's policy outlook pessimistic, oil prices down three days in a row.

- Shenzhen Bay's prime base land transferred: Vanke's slimming plan takes another solid step

站长推荐

Goldmans Global Review: High Risk (Suspected Fraud)

Soybean and corn prices are sharply dropping in global markets, with the cause still unknown.

European natural gas prices hit a yearly high amid Russia

Why did CBOT positions turn bearish, and why did positive market factors flip negative?

IM Markets: A High

Bank of America foresees rising U.S. inflation and a commodity bull market.

TWFG's annual net profit soars nearly 27%, achieving great success after last month's IPO.

Gold prices surged over 1%, driven by two key factors, sparking strong momentum